HDFC ERGO Insurance Agent: Jeevabharathi

-

- Opens at 10:00 AM

- Call Directions

Request a Call Back

Write to us with your query and we shall get back

Type of Enquiry

Thank you for reaching out. For quick assistance,

you can connect with our Customer Care at 02262426242

or

simply click below to call

Our Product Offerings

Types of Insurance Plans

Why Choose HDFC ERGO?

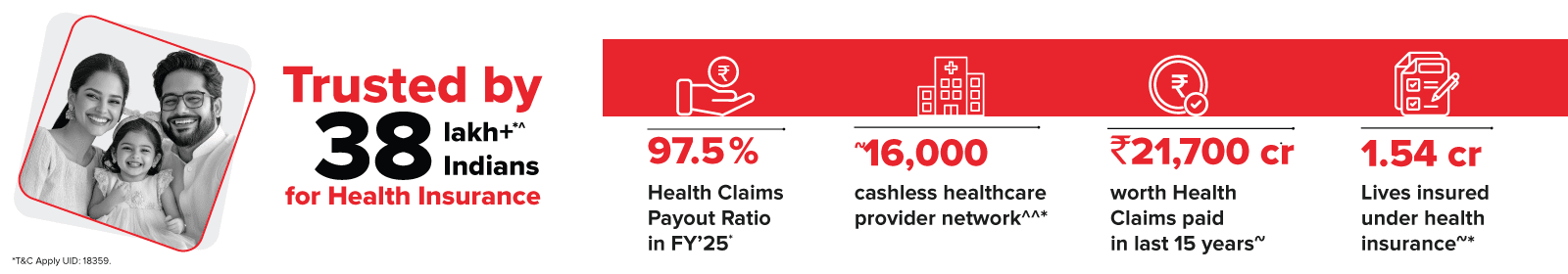

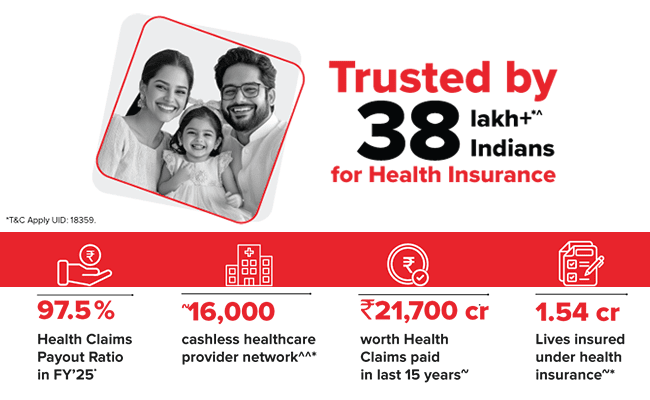

Secured 3.2+ Crore Happy Customers@

Trust redefines relations at HDFC ERGO. We consistently strive to make insurance easier, more affordable and more dependable.

24x7 Claims Assistanceººº

In the time of distress, instant help is the need of the hour. Our in-house claims team is always there to provide a hassle-free claim experience.

23 Years Of Serving India

Since last 23 years, we are committed towards serving India with technology driven insurance solutions with a human heart.

Utmost Transparency

HDFC ERGO General Insurance claims are settled with utmost transparency and ease.

Lauded And Awarded

HDFC ERGO has been recognised as the 'Best General Insurance Company' at the 7th Annual Insurance Conclave & Awards - 2024, organised by Insurance Alerts.

Cashless Network

With our robust network of 15000+ˇˇ Cashless Healthcare providers and 12200+ Cashless Motor Garagesˇ help is never too far.

About HDFC Ergo General Insurance Company Limited

HDFC ERGO General Insurance Company Ltd. is a joint venture between HDFC Ltd., India’s premier Housing Finance Institution and ERGO International AG, the primary insurance entity of Munich Re Group. The Company offers complete range of general insurance products ranging from Motor, Health, Travel, Home and Personal Accident in the retail space and customized products like Property, Marine and Liability Insurance in the corporate space.

The address of this branch is No 13/2, Maruthi Nagar, Salem, Tamil Nadu.

Branch Information

Business Hours

- Mon 10:00 AM - 06:00 PM

- Tue 10:00 AM - 06:00 PM

- Wed 10:00 AM - 06:00 PM

- Thu 10:00 AM - 06:00 PM

- Fri 10:00 AM - 06:00 PM

- Sat 10:00 AM - 06:00 PM

- Sun 10:00 AM - 06:00 PM

Other Branches of HDFC Ergo General Insurance Company Limited

- HDFC Ergo General Insurance Company Limited branches in Tamil Nadu

- HDFC Ergo General Insurance Company Limited branches in Salem

Parking Options

- Free parking on site

Get Direction To HDFC Ergo General Insurance Company Limited

Payment Methods

- Cash

- Credit Card

- Debit Card

- Online Payment

Categories

Blogs

Social Timeline

Frequently Asked Questions

Yes, having a separate individual health insurance plan is important. Your employee health insurance covers medical expenses only till the time you are working in the organization. Once you quit the company, your policy term ends. Keeping medical inflation in mind, it is important to buy personal health insurance as per your medical needs. Also, a corporate health plan is a common plan designed for all employees.

Health insurance portability helps you to change your health insurance plan without having to go through a fresh waiting period term. There is a smooth transfer from one insurer to another if your current plan is not sufficient to cover rising medical costs.

Network hospitals better known as cashless hospitals have an agreement with your insurance company, because of which you can avail cashless hospitalisation benefit. On the other hand, if you get treated In a non-network hospital, you have to pay the bills first and later apply for reimbursement claim. So, it is always wise to buy a health insurance company which has a large network hospital tie-up.

Cashless hospitalisation is a procedure in which the policyholder doesn't have to pay medical expenses out of his pocket in case they are admitted to a hospital or have undergone a surgery. However, there are certain deductibles or non medical expenses at the time of discharge, which are not included in the policy terms, have to be paid at the time of discharge.

In case you have to undergo a surgery, there are certain pre hospitalization expenses such as diagnosis cost, consultations etc Likewise, post the surgery, there could be expenses to monitor the health of the policyholder. These expenses are known as pre and post hospitalization expenses.

You can file multiple numbers of claims during a policy term, provided it is within the limit of the sum insured. A policyholder can get coverage up to sum insured only.

Yes, it is possible to buy more than one medical insurance plan. This entirely depends on an individual's necessity and coverage requirements.

Yes, you can claim medical bills in health insurance, as long as it is within the sum insured. For more information, read the policy wording document.

It usually takes approx.7 working days in settling a claim if documents are in order.

You can check your claim status through self-help portals or mobile apps extended by insurers.

You can get a copy of your car insurance policy online by going through the following steps:

Step 1- Visit the HDFC ERGO website and select the option to download an e-copy of your policy.

Step 2 - Enter your policy number and registered mobile number. An OTP will be sent to that number for verification.

Step 3 - Enter the OTP and provide your registered email ID.

Step 4 - A copy of your car insurance policy will be sent to your mail ID in PDF format. You can then download the policy and print it.

You can use the printout of the soft copy as the original document.

Bumper to bumper insurance is an add on cover in car insurance that protects the vehicle's depreciation value. You can opt for this cover along with your comprehensive car insurance policy. With the help of this add on cover, you can get the complete claim amount from the insurer without deduction of the vehicular part depreciation.

Total Loss: Total loss occurs when the vehicle is stolen and cannot be recovered, or if it is non-repairable or repair costs exceeds the Insured Declared Value (IDV) Constructive Total Loss: Constructive total loss is when the aggregate cost of retrieval and/or repair of the vehicle exceeds 75% of the IDV.** Settlement Procedure:In case of theft of vehicle the company will pay the IDV less any deductible. If a motor vehicle is damaged and is assessed as ‘total loss’ or “constructive total loss” or cash loss; Company shall grant the Policyholder the option to retain the wreck and accept a ‘cash loss’ settlement (being the IDV less deductible less the assessed value of Salvage) based on competitive quotes procured by the Insurer including any submitted by or through the Policyholder.

Yes, selecting a lower IDV (Insured Declared Value) can reduce your premium. However, keep in mind that a lower IDV also means you’ll receive less compensation if your car is stolen or damaged beyond repair. So, it’s important to strike a balance.

Yes. The reward for not claiming during the policy period can be easily transferred from one insurer to another if the policyholder decides to buy insurance from another insurer. Similarly, if the car owner changes his vehicle, NCB can be transferred to the new car. To transfer the NCB, you must request the insurance company to issue you an NCB certificate. This certificate denotes the amount of NCB you are eligible for and becomes proof of NCB transfer.

Insured Declared Value or IDV is the maximum amount of money an insurer will pay out for a vehicle in the event of theft or total loss. IDV in car insurance plays a major role in determining the premium. The IDV is usually fixed at the start of each policy period.

For car insurance claim, you first need to file an FIR at the nearest police station in case of theft or any accident. Locate our cashless network garages on our website. All damages / losses will be surveyed and assessed by our surveyor. The policyholder will also have to fill in the claim form and provide the related documents as mentioned in the form.

Road Side Assistance Cover provides you with the necessary help at the time when your vehicle is stuck in middle of road due to car breakdown. This usually includes towing, changing flat tyre and jump start and many other things. Make sure you read policy wordings to understand the terms and conditions of this cover.

No, you cannot buy any add on covers with third party car insurance. But you can buy several add on if you purchase comprehensive car insurance.

Except for tyres and tubes, Zero depreciation provides coverage to every part of your car.

No Claim bonus is the reward your insurance company will give you for not filing a claim in the previous policy period. It is applicable only from the second policy year, and the discount on premiums ranges from 20%-50%.

A voluntary deductible is a part of the claim that the insured person has to pay from their pocket before raising the claim with the insurance provider. It is an excellent way to reduce your policy premium. For example, say your car is damaged, and the total claim amount is Rs. 10,000. If, you have agreed to pay Rs. 2,000 from your side as a voluntary deductible, the insurer will pay the balance of Rs. 8,000. However, remember that there is also a compulsory deductible portion in your car insurance policy. This is the amount you must pay compulsorily in each instance of a claim, irrespective of whether you are paying a voluntary deductible or not.

We have good news for you here. A medical checkup is not necessary if you are planning to buy the HDFC ERGO travel insurance policy. You can bid goodbye to health checkups and purchase travel insurance without any hassle.

Yes, you most certainly can buy travel insurance after you’ve made a booking for your trip. In fact, it’s a smart idea to do so, because that way, you will have a better idea of the details of your trip, such as the start date, the end date, the number of people accompanying you and the destination. These details are all essential to determine the cost of your travel insurance cover.

Travel insurance is mandatory for traveling to all 26 Schengen countries.

No. HDFC ERGO does not provide multiple insurance plans to the same person for the same trip.

Policy can be taken only if the insured is in India. Cover is not offered for individuals who have already travelled abroad.

Travel insurance acts as a financial safety net and protects you against the possible financial repercussions of unexpected emergencies on your journey. When you purchase a travel insurance policy, you essentially buy a cover against certain insurable events. It offers medical, baggage-related and journey-related coverage. In case any of the insured events, like flight delays, loss of baggage, or medical emergencies occur, your insurer will either reimburse the additional costs that you incur on account of such incidents, or they shall offer a cashless claim settlement for the same.

Emergency medical needs must be treated in time if the need arises. And that is why it is not necessary to get any sort of prior approval from the insurer before you proceed with medical treatment, but it is better to inform the insurance company of the claim. However, the nature of the treatment and the terms of the travel insurance policy will determine if the treatment is covered by the travel insurance.

Well, that depends on where you’re travelling to. To be more specific, there are 34 countries that have made travel insurance mandatory, so you’ll need to purchase a cover before you travel there. These countries include Cuba, The United States of America, The United Arab of Emirates, Ecuador, Antarctica, Qatar, Russia, Turkey and the group of 26 Schengen countries.

The policy provides a cover of up to Rs. 25 Lakhs for theft/damage to your home contents and a cover of up to Rs. 50 Lakhs for third party liabilities on account of accidents.

Yes. The policy offers several add-ons such as portable electronics cover, jewellery and valuables cover, terrorism cover, pedal bicycle cover, etc. Read this blog on Add-on Covers under Home Insurance.

The sum insured can be increased by opting for a higher premium. It can however, not be decreased.

Yes. You can cancel the policy anytime you want. However, please note that retention of premium as per short period scales would be applicable.

The structure is a wider term which can be used to include the building of the property, the compound wall, terrace, garage, etc. The structure, thus, includes the vicinity of the building too. Building, on the other hand, means only the standalone building which is insured. It does not include the surrounding property.

A set formula has been defined to calculate the sum insured for the home building, including all structures. The prevailing cost of construction of the home building being insured, as declared by the policy buyer and accepted by the insurance company, becomes the sum insured. For home contents, built-in cover of 20% of the building sum insured, subject to maximum INR 10 lakhs, is provided. Further cover can be purchased.

HDFC ERGO home insurance can be purchased online seamlessly. Customer support is available 24/7 to solve all queries relating to any policy or any claim.

You would need to submit a duly signed claim form, along with relevant documents attesting theft of or damage to your insured property. In case of theft, a copy of the FIR would be required.

Yes the policy can be renewed on expiration. Follow these simple steps:

1. Log on to https://www.hdfcergo.com/renew-hdfc-ergo-policy

2. Enter your policy number/mobile number/email ID.

3. Check your policy details.

4. Make a quick online payment through your preferred mode of payment.And that’s it. You’re done!

Renewing an existing HDFC ERGO policy is simple and hassle free. Simply provide your policy number along with the documents of your residential property and you are done.